Business Cycle

Business Cycle is basically defined in terms of periods of expansion or recession. It is the downward and upward movement of gross domestic product (GDP) around its long-term growth trend. It is the fluctuation in economic activity that an economy experiences over a period of time. It is usually measured by considering the growth rate of real gross domestic product. Business cycle reflect the possibility that the economy may reach short-run equilibrium at levels below or above full employment.

Stabilization Policy

Legal monopoly, co-operative economics, commodity currency, keeping a safe course in a dangerous environment, inflation and its control mechanism, clinical geropsychology, your peace lily will bloom more “beautifully” if you “avoid” these 5 faults, agronomy science, ligand field theory, latest post, potassium osmate – and inorganic compound, lithium lactate – a salt of lithium and lactic acid, potential benefits of using grass-powered energy production, scientists create a novel technique for high-resolution visualization of magnetic nanostructures, a technique that opens the door to better fuel cell automobiles, sodium lactate.

What is Business Cycles? Phases, Types, Theory, Nature

- Post last modified: 1 August 2021

- Reading time: 40 mins read

- Post category: Economics

What is the Business Cycle?

Business Cycle , also known as the economic cycle or trade cycle , is the fluctuations in economic activities or rise and fall movement of gross domestic product (GDP) around its long-term growth trend.

No era can stay forever. The economy too does not enjoy same periods all the time. Due to its dynamic nature, it moves through various phases.

Table of Content

- 1 What is the Business Cycle?

- 2 Business Cycle Definition

- 3.1 Expansion

- 3.3 Contraction

- 4.1 Cyclical nature

- 4.2 General nature

- 5 Types of Business Cycle

- 6.1 Hawtrey Monetary Theory

- 6.2 Innovation Theory

- 6.3 Keynesian Theory

- 6.4 Hicks Theory

- 6.5 Samuelson theory

- 7 Business Economics Tutorial

The change in business activities due to fluctuations in economic activities over a period of time is known as a business cycle . Business cycle are also called trade cycle or economic cycle. Business Cycle can also help you make better financial decisions.

The economic activities of a country include total output, income level, prices of products and services, employment, and rate of consumption. All these activities are interrelated; if one activity changes, the rest of them also change.

Also Read: What is Economics?

Business Cycle Definition

Arthur F. Burns and Wesley C. Mitchel defined business cycle definition as

Business cycle are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; in duration, business cycle vary from more than one year to ten or twelve years; they are not divisible into shorter cycle of similar characteristics with amplitudes approximating their own. Arthur F. Burns & Wesley C. Mitchel

Also Read: What is Demand in Economics

Phases of Business Cycle

4 Phases of Business Cycle are:

Contraction

Let us discuss 4 phases of business cycle in detail:

Expansion is the first phase of a business cycle . It is often referred to as the growth phase .

In the expansion phase, there is an increase in various economic factors, such as production, employment, output, wages, profits, demand and supply of products, and sales. During this phase, the focus of organisations remains on increasing the demand for their products/services in the market.

The expansion phase is characterised by:

- Increase in demand

- Growth in income

- Rise in competition

- Rise in advertising

- Creation of new policies

- Development of brand loyalty

In this phase, debtors are generally in a good financial condition to repay their debts; therefore, creditors lend money at higher interest rates. This leads to an increase in the flow of money.

In the expansion phase, due to increase in investment opportunities, idle funds of organisations or individuals are utilised for various investment purposes. The expansion phase continues till economic conditions are favourable.

Peak is the next phase after expansion. In this phase, a business reaches at the highest level and the profits are stable. Moreover, organisations make plans for further expansion.

Peak phase is marked by the following features:

- High demand and supply

- High revenue and market share

- Reduced advertising

- Strong brand image

In the peak phase, the economic factors, such as production, profit, sales, and employment, are higher but do not increase further.

An organisation after being at the peak for a period of time begins to decline and enters the phase of contraction. This phase is also known as a recession .

An organisation can be in this phase due to various reasons, such as a change in government policies, rise in the level of competition, unfavourable economic conditions, and labour problems. Due to these problems, the organisation begins to experience a loss of market share.

The important features of the contraction phase are:

- Reduced demand

- Loss in sales and revenue

- Reduced market share

- Increased competition

In Trough phase, an organisation suffers heavy losses and falls at the lowest point. At this stage, both profits and demand reduce. The organisation also loses its competitive position.

The main features of this phase are:

- Lowest income

- Loss of customers

- Adoption of measures for cost-cutting and reduction

- Heavy fall in market share

In this phase, the growth rate of an economy becomes negative. In addition, in trough phase, there is a rapid decline in national income and expenditure.

After studying the business cycle , it is important to study the nature of business cycle .

Read: Difference Between Micro and Macro Economics

Nature of Business Cycle

The nature of business cycle helps the organisation to be prepared for facing uncertainties of the business environment.

Cyclical nature

General nature.

Let us discuss the nature of business cycle in detail.

This is the periodic nature of a business cycle. Periodicity signifies the occurrence of business cycle at regular intervals of time. However, periods of intervals are different for different business cycle . There is a general consensus that a normal business cycle can take 7 to 10 years to complete.

The general nature of a business cycle states that any change in an organisation affects all other organisations too in the industry. Thus, general nature regards the business world as a single economic unit.

For example, depression moves from one organisation to the other and spread throughout the industry. The general nature is also known as synchronism.

Read: What is Business Economics?

Types of Business Cycle

Following the writings of Prof .James Arthur and Schumpeter, we can classify business cycle into three types based on the underlying time period of existence of the cycle as follows:

- Short Kitchin Cycle

- Longer Juglar cycle

- Very long Kondratieff Wave

Short Kitchin Cycle (very short or minor period of the cycle, approximately 40 months duration)

Longer Juglar cycle (major cycles, composed of three minor cycles and of the duration of 10 years or so)

Very long Kondratieff Wave (very long waves of cycle, made up of six major cycles and takes more than 60 years to run its course of duration)

Also Read: Scope of Economics

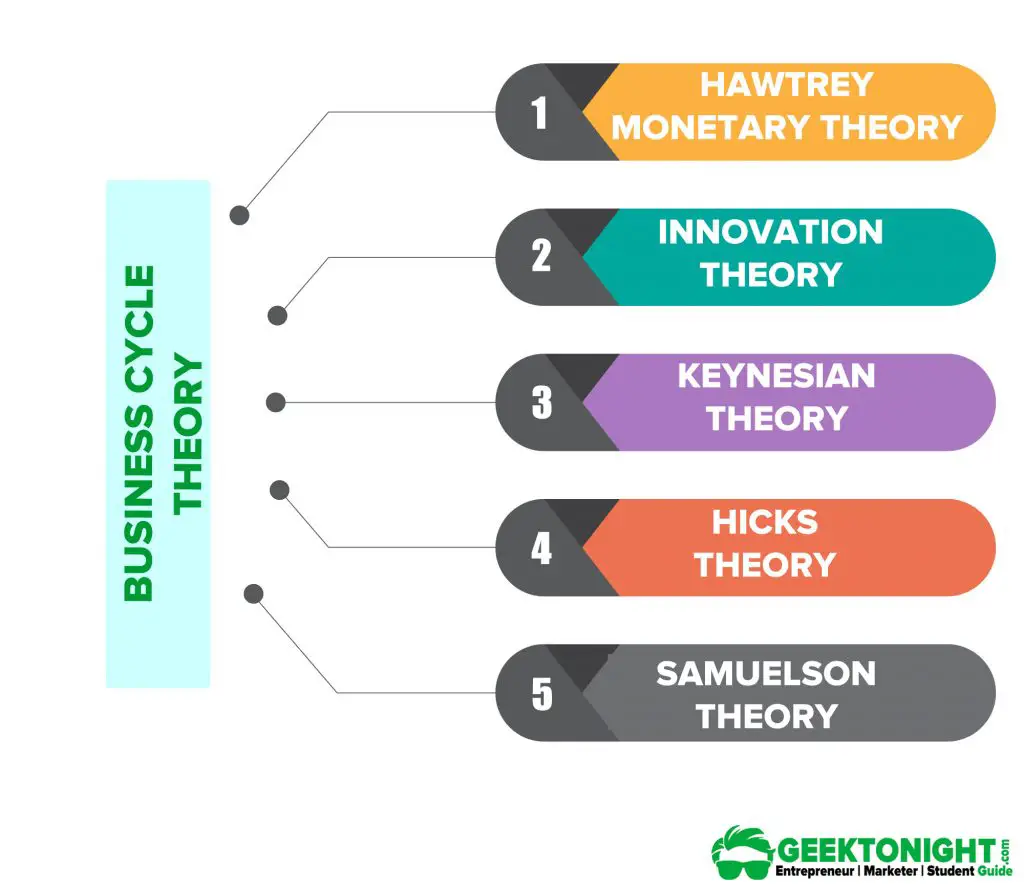

Business Cycle Theory

A business cycle is a complex phenomenon which is common to every economic system. Several theories of business cycle have been propounded from time to time to explain the causes of business cycle.

Business Cycle Theory are:

Hawtrey Monetary Theory

Innovation theory.

- Keynesian theory

Hicks Theory

Samuelson theory.

Hawtray was of opinion that in depression monetary factors play a critical role. The main factor affecting the flow of money and money supply is the credit position by the bank. He made the classical quantity theory of money as the basis of his trade cycle theory .

According to him, both monetary and non-monetary factors also affect trade. His theory is basically the product of the supply of money and expansion of credit. This expansion of credit and other money supply instrument create a cumulative process of expansion which in return increase aggregate demand.

According to this theory the only cause of fluctuations in business is due to instability of bank credit. So it can be concluded that Hawtray’s theory of business cycle is basically depend upon the money supply, bank credits and rate of interests.

Criticism of this Business Cycle theory

- Hawtray neglected the role of non-monetary factors like prosperous agriculture, inventions, rate of profit and stock of capital.

- It only concentrates on the supply of money.

- Increase in interest rates is not only due to economic prosperity but also due to other factors.

- Over-emphasis on the role of wholesalers.

- Too much confidence in monetary policy. vi. Neglect the role of expectations. vii. Incomplete theory of trade cycles.

The innovation theory of business cycle is invented by an American Economist Joseph Schumpeter. According to this theory, the main causes of business cycle are over-innovations.

He takes the meaning of innovation as the introduction and application of such techniques which can help in increasing production by exploiting the existing resources, not by discoveries or inventions. Innovations are always inspired by profits. Whenever innovations are introduced it results into profitability then shared by other producers and result in a decline in profitability.

- Innovation fails to explain the period of boom and depression.

- Innovation may be major factor of investment and economic activities but not the complete process of trade cycle.

- This theory is based on the assumption that every new innovation is financed by the banks and other credit institutions but this cannot be taken as granted because banks finance only short term loans and investments.

Keynesian Theory

The theory suggests that fluctuations in business cycle can be explained by the perceptions on expected rate of profit of the investors. In other words, the downswing in business cycle is caused by the collapse in the marginal efficiency of capital, while revival of the economy is attributed to the optimistic perceptions on the expected rate of profit.

Moreover, Keynesian multiplier theory establishes linkages between change in investment and change in income and employment. However, the theory fails to explain the cumulative character both in the upswing and downswing phases of business cycle and cyclical fluctuations in economic activity with the passage of time.

Hicks extended the earlier multiplier-accelerator interaction theory by considering real world situation. In reality, income and output do not tend to explode; rather they are located at a range specified by the upper ceiling and lower floor determined by the autonomous investment.

In the theory, it is assumed that autonomous investment tends to grow at a constant percentage rate over the long run, the acceleration co-efficient and multiplier co-efficient remain constant throughout the different phases of the trade cycle, saving and investment co-efficient are such that upward movements take away from equilibrium.

The actual output fails to adjust with the equilibrium growth path overtime. In fact it has a tendency to run above it and then below it, and thereby, constitute cyclical fluctuations overtime. This basic intuition can be shown with the help of the following figure.

- Wrong assumption of constant multiplier and acceleration co-efficient.

- Highly mechanical and mathematical device.

- Wrong assumption of no-excess capacity.

- Full-employment ceiling is not independent

According to this theory process of multiplier starts working when autonomous investment takes place in the economy. With the autonomous investment income of the people rises and there is increase in the demand of consumer goods. It directly affected the marginal propensity to consume.

If there is no excess production capacity in the existing industry then existing stock of capital would not be adequate to produce consumer goods to meet the rising demand. Now in order to meet the consumer’s requirements, producers will make new investment which is derived investment and the process of acceleration principle comes into operation.

Then there is rise in income again which in the same manner continue the process of income propagation. So in this way multiplier and acceleration interact and make the income grow at faster rate than expected. After reaching its peak, income comes down to bottom and again start rising.

Autonomous investment is incurred by the government with the objective of social welfare. It is also called public investment. The autonomous investment is the investment which is done for the sake of new inventions in techniques of production.

Derived investment is the investment undertaken in capital equipment which is induced by increase in consumption.

- This model only concentrates on the impact of the multiplier and acceleration and it ignored the role of producer’s expectations, changing business requirements and consumers preferences etc.

- It is not practically possible to compute the fact of multiplier and acceleration principle.

- It has wrong assumption of constant capital output ratio.

Also Read: What is Law of Supply?

- D N Dwivedi, Managerial Economics , 8th ed, Vikas Publishing House

- Petersen, Lewis & Jain, Managerial Economics , 4e, Pearson Education India

- Brigham, & Pappas, (1972). Managerial economics , 13ed. Hinsdale, Ill.: Dryden Press.

- Dean, J. (1951). Managerial economics (1st ed.). New York: Prentice-Hall.

Business Economics Tutorial

( Click on Topic to Read )

- What is Economics?

- Scope of Economics

- Nature of Economics

- What is Business Economics?

- Micro vs Macro Economics

- Laws of Economics

- Economic Statics and Dynamics

- Gross National Product (GNP)

- What is Business Cycle?

- W hat is Inflation?

- What is Demand?

- Types of Demand

- Determinants of Demand

- Law of Demand

- What is Demand Schedule?

- What is Demand Curve?

- What is Demand Function?

- Demand Curve Shifts

- What is Supply?

- Determinants of Supply

- Law of Supply

- What is Supply Schedule?

- What is Supply Curve?

- Supply Curve Shifts

- What is Market Equilibrium?

Consumer Demand Analysis

- Consumer Demand

- Utility in Economics

- Law of Diminishing Marginal Utility

- Cardinal and Ordinal Utility

- Indifference Curve

- Marginal Rate of Substitution

- Budget Line

- Consumer Equilibrium

- Revealed Preference Theory

Elasticity of Demand & Supply

- Elasticity of Demand

- Price Elasticity of Demand

- Types of Price Elasticity of Demand

- Factors Affecting Price Elasticity of Demand

- Importance of Price Elasticity of Demand

- Income Elasticity of Demand

- Cross Elasticity of Demand

- Advertisement Elasticity of Demand

- Elasticity of Supply

Cost & Production Analysis

- Production in Economics

- Production Possibility Curve

- Production Function

- Types of Production Functions

- Production in the Short Run

- Law of Diminishing Returns

- Isoquant Curve

- Producer Equilibrium

- Returns to Scale

Cost and Revenue Analysis

- Types of Cost

- Short Run Cost

- Long Run Cost

- Economies and Diseconomies of Scale

- What is Revenue?

Market Structure

- Types of Market Structures

- Profit Maximization

- What is Market Power?

- Demand Forecasting

- Methods of Demand Forecasting

Criteria for Good Demand Forecasting

Market Failure

- What Market Failure?

- Price Ceiling and Price Floor

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Business Cycle | Business Economics in the comments section.

- What is Inflation?

- Determinants of Demand

You Might Also Like

Types of Demand in Economics

What is Demand Function? Types, Example, Graph, Formula

What is the Elasticity of Demand? Definition, Formula, Example, Types

What is Supply? Definition, Concept, Determinants, Types, Function

Types of Production Functions: Cobb Douglas, Leontief, CES

What is a Production Possibility Curve? Definition, Example, Formula

What is budget line definition, concept, shift, slope, consumer equilibrium: effects on income, substitution, price, what is long run cost type: total, average, marginal.

Types of Costs

What is Cross Elasticity of Demand? Formula, Types, Example

Leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

- CEE Book Store

Username or Email Address

Remember Me

Forgot Password?

Don't have an account yet? Sign up for free

- Browse All Resources

- Browse by Collection

- ReadyAssessments

- 2025 Winter Institute

- Upcoming Webinars

- Webinar Series

- Most Popular Webinars

- All Webinars

- Invest in Girls

- National Personal Finance Challenge

- National Economics Challenge

- Women Talk Money: Teen Girl Learning Series

- Family-At-Home Financial Fun Pack

The Business Cycle: Introduction to Macroeconomic Indicators

Students will be able to:

- Define and label the phases of the business cycle.

- Understand and define the general meaning of the terms associated with business cycle.

- Understand that the business cycle is comprised of expansions and contractions of the GDP within the economy.

National Standards in Economics

National Standards in Financial Literacy

State Standards

Common Core State Standards

In this economics lesson, students will analyze graphs to learn the parts of the business cycle.

Tell students this lesson will help them understand a basic macroeconomic tool called the business cycle. Have students look at either FRED from the St. Louis Fed or project the graph in the link on the board for them to see. Ask students: “How do you think the economy is doing right now?”and give them sufficient time to respond. If they do not respond or need more prompting, ask: “Is the economy growing (going up) or shrinking (going down)?” Follow up by asking: “What factors do you think is causing economic activity to be up (or down)?”

Open the PowerPoint titled The Business Cycle . Slide 2: Explain that these will be the key words used to discuss the business cycle. Tell students that a business cycle is just a period of expansion and contraction of the economy, measured by changes in the real GDP, or Gross Domestic Product. Slide 3: Walk students through the phases of the business cycle, discussing each phase and giving students enough time to copy the slide into the notes. Explain the following: In the expansion part of the cycle, GDP is growing, unemployment is going down, but inflation may be rising. In the contraction part of the cycle, GDP is shrinking, unemployment is growing, and inflation may stall or shrink. Slides 4 and 5 are the vocabulary terms with definitions. Talk about these definitions and give students enough time to copy them. You may also want to go back to slide 3 to discuss them. Slide 6: Have one or more students come to the board to draw and label the business cycle.

Group Activity

Put students in pairs to complete the Business Cycle Activity. Distribute one copy of the cards and answer sheet to each pair of students. Tell students that you will be reading each statement, then giving them one minute to discuss the potential answer with their partner. Once selecting an answer, they should place an X showing their answer and hold up the card corresponding with their answer. Start the activity, stopping to review and discuss student answers after each statement. After completing the activity, ask students if they have any questions about the business cycle.

Individual Activity

Distribute a copy of Drawing a Business Cycle activity to each students. Tell students they should review the information and complete the assignment. Debrief the assignment by reviewing student answers. (Answers will vary, but be sure each graph has the four phases of the business cycle. Unemployment should increase during a recession and decrease during a recovery.)

Have students complete the Kahoot! Business Cycle Ticket and see the answers here.

Have students complete the worksheet “ The Great Recession “. The article can be accessed electronically or printed out for students. Tell students to read the article and answer the questions from the reading. Review their answers and answer any questions they may have.

Put students into small groups. Randomly assigned each group a 10-year period (1980-1990, 1970-1980, etc.). Have each group visit The Balance web site to plot the GDP for each year in their ten year cycle. Be sure they label the phases of their business cycle and identify the lowest/highest periods of unemployment. You may choose to have them complete this assignment on the computer or with graph paper. Have the groups present their graphs to the class in sequence, explaining the parts of the business cycle for that 10-year period. You may also want them to post their graphs on the board for a historical perspective of the U.S. economy.

Fred St. Louis Fed

Resource Slides

Group Activity Cards

The Business Cycle Group Activity

The Business Cycle Group Activity Answer Key

Drawing a Business Cycle

Kahoot! Game

The Business Cycle Ticket out the Door (Kahoot)

The Great Recession

The Great Recession Answer Key

The Great Recession article

The Balance.com GDP

Related Resources

Grades 9-12

Women in the US Workforce During WWII - Measuring Unemployment

Economic misery and presidential elections.

Content Partner

Grades Higher Education, 9-12

The Potential Impact of the USMCA on US Manufacturing Jobs

Sign up for free membership.

Economics Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

💡 Expert-Led Sessions 📊 Build Financial Models ⏳ 60+ Hours Learning

Business Cycle

Publication Date :

08 Nov, 2021

Blog Author :

WallStreetMojo Team

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

Business Cycle Definition

The business cycle refers to the alternating phases of economic growth and decline. Since the phases are recurring, they often occur in an identifiable pattern where one phase usually follows the other.

This cyclical nature of the economy is taken into account when policymakers make major decisions. Just because the cycles are repetitive doesn't mean they can be avoided. The fluctuations are caused by parameters like GDP, production, employment, aggregate demand, real income , and consumer spending. Business cycles are also called trade cycles or economic cycles.

Table of contents

Business cycle in economics explained, business cycle phases with graph.

- Example of Business Cycle

Limitations

Frequently asked questions (faqs), recommended articles.

- A business cycle is the repetitive economic changes that take place in a country over a period. It is identified through the variations in the GDP along with other macroeconomics indexes.

- The four phases of the business cycle are expansion, peak, contraction, and trough.

- The risk and adverse effects of the phases can be mitigated through wisely devising monetary and fiscal policies.

- The National Bureau of Economic Research (NBER) in the US has formed a Businss Cycle Dating Committee (BCDC) for recognizing, tracking, and reporting the different economic phases.

A business cycle is a macroeconomic oscillation that affects the nation's growth and productivity. They are also called trade cycles or economic cycles. NBER is a US-based non-profit organization. It is a private non-partisan research organization. The National Bureau of Economic Research (NBER) identifies and gauges the economic cycle. It has a Business Cycle Dating Committee responsible for keeping the chronological record of the economic stages. To determine economic conditions NBER uses the following parameters; GDP, production, employment, aggregate demand, real income, and consumer spending.

The Keynesian economic theory emphasizes the impact of demand on the business cycle. It believes that the government needs to correct the economic deflation and attain a full employment level when the aggregate demand shifts to the left. Moreover, the Real Business Cycle (RBC) and New Classical economics suggest that the economy reaches a new equilibrium whenever there is a shift in the aggregate supply. Ultimately the economy has a self-healing mechanism and doesn't require government intervention.

Every capitalist economy repeatedly goes through the different phases of the business cycle, i.e., expansion, peak, contraction, and trough. Although these ups and downs in the economy may correct by themselves in the long run, the government and the central bank use economic policies to reduce the impact of trade cycle fluctuations. At the same time, the central bank can inject expansionary or contractionary monetary policies like interest rate changes or supply of money. Further, to mitigate fluctuations, the government uses fiscal policy tools like tax rates and government spending. These measures are taken to avoid risky situations like stagflation or hyperinflation.

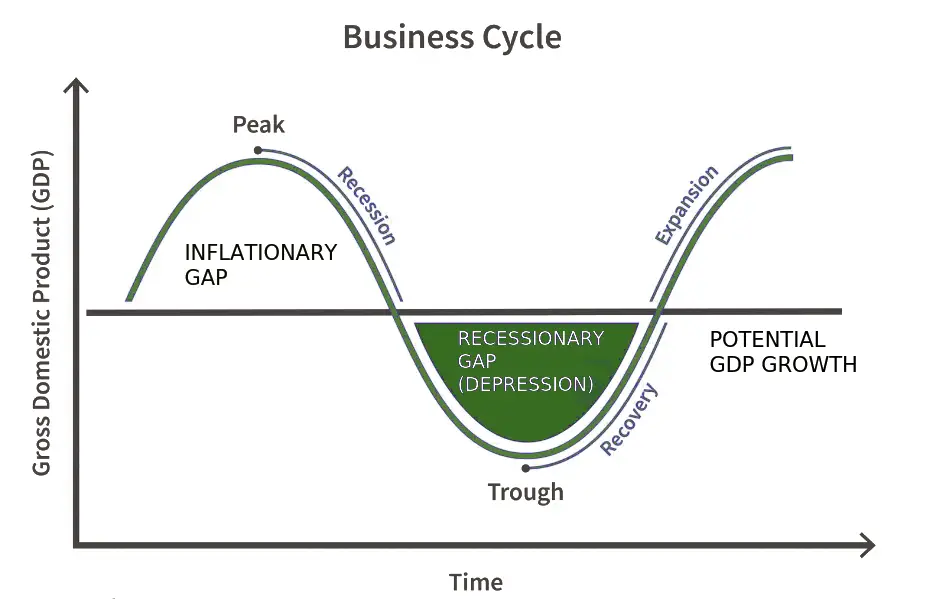

A country keeps track of the trade cycle to ensure that the economy is on the path of growth, unemployment steeps down, and the inflation rate remains under control. To understand the economic fluctuations and pattern, let us have a look at the following graph:

An economy is expected to have constant growth, represented by the growth trend line. In reality, though, the economy is unstable. National output goes up and down periodically. It expands to touch the peak and contracts down to the trough.

Thus, a trade cycle consists of the following four phases:

- Expansion : When a nation's GDP shows an upward move or recovers with time, this period of growth is remarked as economic expansion. During this phase, the various economic indicators like consumer spending, income, demand, supply, employment, output, and business returns shoot up.

- Peak : During the expansion phase, the GDP spikes to its highest level; this is considered the economy's peak. At this point, economic factors like income, consumer spending, and employment level remain constant.

- Contraction : Next comes the phase of economic slowdown; it occurs when the stagnant peak GDP starts tumbling down towards the trough. With this, the nation's production, employment level, demand, supply, income level, and other economic parameters plummet.

- Trough : This is the stage at which the GDP and other economic indicators are at their lowest. During this phase, the economy gets stuck at a negative growth rate. Additionally, the demand for goods and services reduces.

Example of Business Cycle

Nigeria is one of the largest economies in Africa. Yet, Nigeria's economy contracted by almost 1.92% in the second and third quarter of 2020 amidst the Covid 19 Pandemic. According to Reuters, this trashed the nation's GDP that grew by nearly 2.2% in 2019, after recovering from 2016's contraction.

The reason behind this trade cycle fluctuation was the fall in demand and prices of crude oil globally. The lockdown and Covid measures imposed in many countries hit hard. Manufacturing, aviation, trade, hospitality, transportation, and many other industrial sectors slowed down. These industries directly or indirectly needed crude oil, the demand for the commodity dropped.

However, this contraction was short-lived; Nigeria showed a recovery in the last quarter of 2020 as Covid restrictions were eased out to some extent. According to the National Bureau of Statistics (NBS), the nation's growth rate was up by 0.11% in the fourth quarter of 2020. In contrast, the non-oil sectors like food manufacturing, telecom, construction, crop production, and real estate marked a phenomenal growth of 1.69% during the same period.

The effect of the pandemic on Nigeria was not as harsh as IMF anticipated. The contraction was only 3.2%. Subsequently, by 2021 the IMF assumes a 1.5% growth in the nation's economy.

Predicting the business cycle phase is crucial for policymakers and governments so that they can deal with deflation and inflation accordingly. The cycle also warns investors, owners, consumers, and strategists. However, the following are the disadvantages associated with the business cycle:

- Limited Information : Since the economic cycle analysis is based on research, it becomes difficult for economists to access complete and accurate data. Moreover, the process of correlating and interpreting acquired information is equally challenging.

- Two Contrasting Models : The Keynesian theories consider money supply to be the important factor behind fluctuations. But the Real Business Cycle theory opposes this concept and proposes that market imperfection is the important factor behind fluctuations.

- Human Glitch : Economic researchers are humans; they are the ones who study trade cycle trends and present economic indicators that cause the trend. Thus, this analysis is prone to human errors.

A business cycle refers to the long-term fluctuations in the economic output of a nation. In other words, it is the upswing or downfall of a country's GDP. This is also applied to a particular product or a segment of the market.

The changing Gross Domestic Product (GDP) of any nation triggers the fluctuations. The GDP itself rises or falls due to the impact of various demand factors like monetary policy, credit cycle, consumer confidence, housing prices, accelerator effect, multiplier effect, income effect, and exchange rate. The economy is affected by the following supply factors: population, financial instability, lending cycle, unemployment, labor market condition, technological changes, and inventory cycle.

A typical business cycle persists for 5.5 years on average; however, it may be shorter or longer than this. While the economy self-corrects over time, various monetary and fiscal policy measures are implemented to create economic balance.

This has been a guide to Business Cycle and its Definition. Here we discuss 4 phases of the business cycle in economics using graphs and examples. You can learn more about economics from the following articles -

- Formula of Operating Cycle

- Accounting Cycle

- Formula of Cash Conversion Cycle

- Accounts Payable Cycle

- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Assignment in Business Cycle $

Management science (ac 1103), university of san carlos.

Recommended for you

Students also viewed.

- EOQ-Problems

- Management Consultancy or Management Advisory Services

- Risk And Return

- Philo chap 5 - ffefef

- Introduction to Management Science

- Mansci - Topic 2; Chapter 13

Related documents

- 57-84 - ....

- Portfolio Risk and Returns

- Net To PLCsim-Manual-en

- Introduction to Decision Making with Quantitative Approach

- Assignment for Chap 7 Buying $

- Chapter 1 Management Science

Preview text

Assignment in Business Cycle & Balance of Payment

- Illustrate and explain thoroughly the business cycle A business cycle refers to the fluctuations in Gross Domestic Product (GDP) around its long-term natural growth rate, marked by periods of expansion and contraction in economic activity. It begins with expansion, characterized by increasing employment, income, output, wages, profits, and demand for goods and services, along with high investment and money supply velocity. The cycle reaches a peak, the maximum economic growth point, where economic indicators are at their highest. This is followed by a recession, where demand for goods and services declines, leading to excess supply and a fall in income, output, and wages. If the decline continues, the economy enters a depression, marked by significant unemployment and prolonged economic downturn below the steady growth line. The trough is the lowest point of the cycle, where national income and expenditure are extensively depleted. Finally, the economy moves into recovery, where demand and supply increase, employment rises, and investments grow, returning to steady growth levels and completing the cycle.

- Give specific example(s) situation in each cycle stage. Expansion Example: The period between 2010 and 2019 in the United States saw significant economic growth following the recovery from the Great Recession. During this time, the unemployment rate decreased, GDP grew steadily, and stock markets reached new highs. Peak Example: In late 2007, the U. economy reached its peak before the onset of the Great Recession. Housing prices were at their highest, and employment levels were robust. However, signs of economic overheating and financial instability began to emerge. Recession Example: The Great Recession, which began in December 2007 and lasted until June 2009, saw a significant decline in economic activity. Unemployment rates soared, GDP contracted, and many businesses closed or reduced operations. Depression Example: The Great Depression of the 1930s is a classic example. Following the stock market crash of 1929, the U. economy entered a severe downturn. Unemployment reached around 25%, GDP fell sharply, and widespread poverty and deflation occurred. Trough Example: The trough of the Great Recession occurred around mid-2009 when economic indicators were at their lowest. Unemployment peaked, and GDP growth was negative, but the economy began to stabilize and set the stage for recovery. Recovery

- Multiple Choice

Course : Management Science (AC 1103)

University : university of san carlos.

- More from: Management Science AC 1103 University of San Carlos 109 Documents Go to course

IMAGES

COMMENTS

Study with Quizlet and memorize flashcards containing terms like Which point marks a peak? Which point marks a trough? Which point marks a recession? Which point marks a recovery?, How does the business cycle affect consumers? Check all that apply., At which point of the business cycle would prices probably be highest? and more.

Objectives *To understand the meaning and concept of business cycles *To understand the different theories of business cycles Keywords Business cycle, Business theories, Trade cycle QUADRANT -I Module 39: Business Cycles 1. Learning Objectives 2. Introduction 3. Features of Trade Cycles 4. Phases of Business Cycles 5. Types of Business Cycles 6.

with internet access to complete the assignment. Review answers with students when complete. 9. As a culminating activity, students will find newspaper articles related to the economic measures and business cycle. Instruct students to complete typed reflection for each article they find (assignment sheet

Business Cycle is basically defined in terms of periods of expansion or recession. It is the downward and upward movement of gross domestic product (GDP) around its long-term growth trend. It is the fluctuation in economic activity that an economy experiences over a period of time.

The change in business activities due to fluctuations in economic activities over a period of time is known as a business cycle. Business cycle are also called trade cycle or economic cycle. Business Cycle can also help you make better financial decisions.. The economic activities of a country include total output, income level, prices of products and services, employment, and rate of consumption.

The real business cycle theory argues that business cycles are caused by changes in productivity, while the Austrian theory attributes business cycles to misallocations of resources due to the manipulation of interest rates by central banks. Business cycles can have significant impacts on businesses and individuals.

After completing the activity, ask students if they have any questions about the business cycle. Individual Activity. Distribute a copy of Drawing a Business Cycle activity to each students. Tell students they should review the information and complete the assignment. Debrief the assignment by reviewing student answers.

Macroeconomics Business Cycles Business Cycles Burns and Mitchell [1,p.1]: Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises. A cycle consists of expansions occurring at about the same time in many economic activities, followed by

How long do business cycles last? A typical business cycle persists for 5.5 years on average; however, it may be shorter or longer than this. While the economy self-corrects over time, various monetary and fiscal policy measures are implemented to create economic balance.

Assignment in Business Cycle & Balance of Payment. Illustrate and explain thoroughly the business cycle A business cycle refers to the fluctuations in Gross Domestic Product (GDP) around its long-term natural growth rate, marked by periods of expansion and contraction in economic activity. It begins with expansion, characterized by ...