Need a consultation? Call now:

Talk to our experts:

- Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- Business Valuation

- How it works

- Business Plan Templates

Trading Business Plan

Published Mar.29, 2024

Updated Dec.18, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

Table of Content

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company , positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry size and growth forecast.

According to a report , the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan , a stock trading business offers various services, including:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Direct Market Access (DMA)

- Global Market Access

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more. If you’re considering a change in immigration status to facilitate your business, understanding the EB3 to EB2 conversion process in business can be vital for optimizing workforce and talent management.

Bank/SBA Business Plan

Creating a trading business plan.

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans. Consulting with a pitch deck specialist can be beneficial in preparing a compelling presentation for potential investors.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

Executive summary, company overview.

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team. An E2 visa business plan example can serve as a helpful guide if international expansion is a consideration.

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

Projected Cash Flow Statement

Projected Balance Sheet

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas , assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum . The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

- Free Courses

- Trading Room

Trade 1,000’s of Markets 0% Commission Accounts

0% Commission Accounts

- Trade 1,000’s of global markets.

- 0% deposit and withdrawal fees.

- Rapid funding turn-around times.

- Trade on MetaTrader 4 and 5.

Trading Plan Template [Free PDF Download]

- 6 mins read ●

- Published: 11 May 2022

- Last Updated: 16 September 2024

Needless to say, having a plan before you start trading is essential to your success as a trader. Every experienced trader will tell you that when you enter the markets, you risk your money and, more importantly, your ego and confidence in yourself.

- A well-thought-out trading plan is crucial for forex trading success, safeguarding both finances and self-confidence.

- While many traders are naturally skilled, creating a clear trading plan can still be challenging.

- Using a trading plan template can streamline your strategy and increase chances of consistent profits.

This article will help you with everything you need to know about developing a trading plan . We’ll also include a trading plan PDF, a trading plan Excel template , and a Word document that you can download and use in your trading journey.

- What is a Trading Plan Template

Trading Plan Template FREE Downloads

- How to Build Your Own Trading Plan Template?

1. Set Your Trading Goals – Financially and Emotionally

2. get familiar with trading jargon and analysis methods, 3. develop a trading strategy, 4. set a risk reward ratio, 5. always learn and grow, 6. make an organized trading track record.

- BOONUS: Trading Plan Infographic

What is a Trading Plan Template?

As the name implies, a trading plan is a set of rules and guidelines that a trader follows to execute a trade. Besides that, a trading plan might include suggestions for a healthy trading daily routine and tasks, hence a trading checklist , that will help you manage your account and control your emotions.

For example, with a trading plan, you can define your:

- trading goals

- strengths and weaknesses

- risk management strategy

- trading strategy

- entry rules

- daily routine

- and much more

In this section, we have created free trading plans that you can use in the format of your preference.

- Trading Plan Template PDF

- Trading Plan Template Google Sheets

- Trading Plan Template Word

How to Build Your Trading Plan Template in 6 Easy Steps

So, now that you understand what a forex trading plan is, you need to create a specific plan that matches your style and personality. Personally, while working as a trader in a proprietary trading firm , I remember every trader had a different method, routine, tasks, and rules.

For example, some traders like adding sticky notes on their desktops while others prefer a clean table. Some traders enter hundreds of trades in one trading day while others enter one or two trades in a day. So, it’s up to you to define your own plan and trading strategies .

Nonetheless, based on my knowledge and experience, there are some must-have steps you need to consider to develop a successful trading plan .

You can download our trading plan template PDF below and check the steps on how to develop your trading plan later in this article.

First and foremost, you must define your trading goals. In other words, you will need to know what you plan to achieve from your trading experience.

To help yourself, ask these questions :

- Is it an additional income only? Your main income?

- Do you plan to get rich from trading?

- What is the trading capital you are willing to risk and what is your profit target?

- How many hours a day do you plan to spend on trading?

In that aspect, you’d be surprised to know that many people who become professional experienced traders do not necessarily do it to make money.

Instead, some traders do it for fun, a hobby, or a competitive game. So consider these factors as well. If this is the case for you, then you need to know it before you start trading. Maybe it can give you an advantage over other participants in the forex market.

Before you make your first trade in the forex market, you first must understand the trading jargon and the different analysis methods.

If needed, take a quick trading course to learn how the forex or the stock market works, read articles, books, financial sites, etc. Additionally, you better explore the two methods to analyze financial assets – technical analysis and fundamental analysis .

Then, find the best way for you to analyze the markets and read Forex charts. It’s up to you to decide whether you want to use line, bar, or candlestick charts and, more importantly, what technical indicators you want to use.

Additionally, you can learn how to read popular chart patterns and use them to find trading opportunities. Once again, you have to try before you know it.

There are no two traders that are precisely the same. Therefore, you must find your trading strategy and trading style. This is a result of trial and error. It might take weeks or months until you get to the point where you have established a successful trading strategy, and there’s no way to escape this step.

When you make your first step in the trading world, you’ll get familiar with the different trading strategies – position trading, swing trading, day trading, and scalping trading. Moreover, you can try different strategies such as the naked trading strategy or the 5-3-1 forex trading strategy .

Keep in mind that there are many trading strategies to choose from, but you’ll have to find your unique trading style and strategy within time. For that matter, you need to use trading plans at the beginning of your journey to find the right strategy that matches your personality.

Trading risk management is a predefined strategy to minimize losses and maximize profits. A trader can use many tools and risk management rules to protect themselves from losses and effectively manage their trading account.

There’s one tool used by many traders, which is the most basic and the most effective of all – That is the risk-reward ratio .

In simple terms, a risk-reward ratio is a method to calculate the potential profit of a trade/day/week/month to a potential loss. In other words, it is a method to define your trade risk, that is how much risk you are willing in a trader, or in a day (the method is particularly for day trading).

For example, if you decide to use a risk-reward of 2:1, you are essentially willing to risk $1 for each trade to earn $2.

Trading is not like most professions. The markets always change, the technology evolves, and even the dynamic of the markets is constantly changing. Trust me, financial markets are not the same as they used to be fifteen years ago, and most likely, they will change again in the future.

I mean, the cryptocurrency market is one good example of the unpredictable nature of the trading world and financial markets.

This way or the other, you must read trading books and articles, watch trading movies and listen to trading podcasts – everything you can do to increase your knowledge. Yes, knowledge is power, but in trading, knowledge is essential.

In the final step, make sure you analyze your trading past performance and keep track of your winning and losing trades. Yes, it’s an annoying task, especially when you have a losing day.

Writing down your losing trades is a punch to your ego, but it will help you improve your performance and trading decisions in the future. By doing so, you can learn your worst-performing days of the week, hours, financial instruments, etc.

Luckily, in most retail investor accounts, you can enter your trading platform and extract your daily/weekly/monthly performance. So, in the words of Forrest Gump: “One less thing to worry about”.

BONUS: Trading Plan Action Plan Infographic

Here is an infographic with 6 action steps for your trading plan.

You can also check our blog post about using a trading journal template [free Google Sheets and Excel spreadsheets included]

Over to You

In a nutshell, every trader must have a well-defined solid trading plan . Developing an organized trading system is the first step in becoming a professional and successful trader and will increase your chances of success over the short and long term. It will also develop and keep your trading psychology in check as one of the main factors for successful trading.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.

Related Posts

Published on: 11 May 2023 Blog

Trading Journal Template [Free Excel Sheet Included]

Read More >>

Published on: 27 March 2024 Blog

6 Most Common Trading Mistakes And How To Avoid Them

Published on: 6 March 2024 Blog

How Long Does It Take To Learn Forex Trading?

We’ll Make You A Smarter Trader For Free

Subscribe for on-demand lessons, trade ideas, trading challenges and weekly newsletters packed with actionable information.

Welcome Aboard!

Get ready to receive cutting-edge analysis, top-notch education, and actionable tips straight to your inbox.

Start learning how to trade today!

Or register using

Already have an account? Sign in

Great, you've been entered into our monthly prize draw. We'll notify you if you've won.

Thank you for downloading our trading plan!

Nice to meet you . Let’s ensure you receive relevant content...

2. Do you have a brokerage account? *

Are you planning to open a brokerage account in the near future?

A few last questions then you’re done!

2. What markets are you interested in trading? *

Thank you, you’re all set!

Welcome back to HowToTrade

Choose which account to use below:

Don’t have an account? Register

Reset your password

Type your email and we'll send you a reset link

A password reset has been requested for . Check your email for your reset link.

Disclaimer: The information on the HowToTrade.com website and inside our Trading Academy platform is intended for educational purposes and is not to be construed as investment advice. Trading the financial markets carries a high level of risk and may not be suitable for all investors. Before trading, you should carefully consider your investment objectives, experience, and risk appetite. Only trade with money you are prepared to lose. Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance.

HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Academy. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

The HowToTrade.com website uses cookies in order to provide you with the best experience. By visiting our website with your browser set to allow cookies, or by accepting our Cookie Policy notification you consent to our Privacy Policy, which details our Cookie Policy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This website uses cookies

Are you ready to take your trading to the next level.

Subscribe to our email newsletter below to be reminded then the next live stream begins.

Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Trading Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Trading Company

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to Write a Business Plan for a Trading Company

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and drop shippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

Trading Plan Template & Examples: Step-by-Step Guide to Creating a Solid Trading Plan

Bonus Material:

Trading plans are an important part of any trader’s toolkit. The problem is, most traders don’t actively lay out a plan before they begin trading.

The result? They lose money and wonder why . Furthermore, many traders don’t know how to create a trading plan , or what to include.

Successful traders understand that trading plans are crucial to profiting consistently. In this article, I’ll walk you through creating your own plan, step-by-step, plus you can get a head start by using my free trading plan template, download below :

What is a trading plan?

A trading plan is an integral part of a trader’s strategy, outlining how trades are executed. It establishes rules for buying and selling securities, position sizing, risk management, and tradable securities. By following this plan, traders maintain discipline, consistency, and leverage proven strategies.

Why you should create a trading plan

Ask a new trader what they intend to do before the trading day and then ask them what they did at the end of the day. They almost certainly didn’t follow their plan.

Trading plans are there for us to follow. Trading plans mean we take trades that are consistent with our rules and risk, and it means we remove a lot of emotion and discretion . This is important because humans are not rational agents and outsourcing this work means we can achieve a better P&L and make more money.

A trading plan should resemble a business plan. A trader’s capital is their business and so we need to include everything that might be useful, but it should always cover the below.

What to include in your trading plan

- The time required to spend on your trading

Your trading goals and targets

- Your risk tolerance and risk management rules

Available capital for trading

Specific markets you wish to trade, the trading strategies you’ll use, your motivation for trading.

Read more information on what to include in your trading plan (with examples) below, and download your free template here:

The time required for trading

We need to define the time we need in order to trade successfully. For example, if you’re in full-time employment, then it’s unrealistic to spend six hours a day trading the market.

For example: Here is a part of my trading plan…

“To trade the UK stock market on a full-time basis I realistically need to spend at least 8-10 hours per day in order to take advantage of intraday opportunities and manage open positions in real time”.

It’s important to set realistic targets in trading. Once you have a target, you can reverse engineer how to achieve it.

For example: A target of increasing a trading account by 20% is an achievable target. To do that, we need to look at our trading capital and work out which trading strategies we’ll use.

Using breakouts to trend follow is a strategy I have had much success with, and I explain how I do this in my guide to breakouts.

There are several trading styles:

- Swing trading: This is a common strategy that attempts to capture moves over several days or weeks. Swing traders look for shorter term trends and then move onto the next trade.

- Momentum trading: This is a trend-following strategy based on upward movement and momentum. It can be a successful strategy over months and years as the stock continues to move higher. This is often coupled with increasing fundamental strength and accelerating earnings.

- Scalping or intraday trading (also known as ‘day trading’): Intraday strategies refer to trades placed and closed within the same trading session.

Your risk tolerance and risk management rules

Risk management is the most important part of trading. Position sizing is the first and last line of defence in our trading accounts.

If you take position sizes with 20% of your account, then that means you are risking 100% of that position every time it is risked in the market. Even if the chances are 99%, then eventually that 1 in 100 chance of the stock going to 0p and losing 100% of the position will happen.

Whilst a 20% drawdown on the trading account isn’t fatal, the law of compounding means that we will now need to gain 25% of our account just to get back to where we started.

Never underestimate the numbers here – a 33% drawdown requires a near 50% gain just to get back to where we started.

It’s important to put in place risk management rules that will protect the account and prevent us from taking on too much risk.

Only you will know how much risk you’re willing to take, but if you put yourself in a position where you could do yourself material damage, then eventually that outcome will be presented.

If taking a loss hurts, then it means you are trading too large. Most traders blow their accounts due to overexposure. I’ve never heard of a single trader who blew their account due to continuously taking small losses. Position sizing and risk management is covered in detail in my trading handbook.

Download the free ebook now

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit on AIM stocks.

Traders should always be clear about what money should be used for trading and what money should stay in their bank accounts.

Far too many traders have drawdowns in their trading accounts and decide to top up their account with a bank transfer.

Unfortunately, they end up putting far too much money into their account and do not keep track of their losses.

You should never trade with money you can’t afford to lose. I’ve had emails from people asking me what to do because they’ve lost the deposit for their house and they haven’t told their partner. Sadly, there is little that can be done at that point because the money is already lost.

In your trading plan you should be clear about how much is going into your trading account and how much you will top this up each month if that is going to be your strategy to grow your account further.

However, the best way of growing your trading account is by making money trading successfully in the market. Once you can consistently do this, then it makes sense to increase your funds and scale up.

A trading plan should also include the specific markets you wish to trade. Do you plan on trading UK stocks, US stocks, foreign exchange (forex), or cryptocurrencies? Once you’ve picked a market, you still need to drill deeper.

For example: If you pick UK stocks will you trade all of these, or just AIM, or just the Main Market? Will you trade only small cap stocks? Will you trade both SETS and the SETSqx platforms ?

In my case, I trade all UK stocks, and don’t discriminate between any of them. However, my focus is on smaller stocks under £500 million market cap.

Your trading strategies are the ways you are going to make money. This part of the trading plan is important because by defining your strategies it will be clear to follow.

For example: I want to trade small-cap stocks that have momentum behind them, and I will find this momentum through technical breakouts and positive RNS announcements.

I will trade gaps and also place orders into the auctions in order to get better fills. I will use various brokers for different types of execution. I will take secondary raises that have news catalysts that can potentially drive the shares higher.

What is your why? What are your goals, and what is your motivation? Trading is hard and there are ups and downs – it’s easy to motivate yourself when the going is good and you’re making lots of money. But it can be harder when you’re suffered several losses in a row, and you keep seeing your account grind lower or flat for weeks on end.

Writing down your why will make it easier to stay focused and commit to the long-term process and improvement.

For example:

- I want to trade because I enjoy the challenge and I also want to be my own boss.

- I want the freedom that comes with the lifestyle of a full time trader and I want to be around my wife and future children as they grow up.

- I want to offer my family a better life, and by continuing to work on my skillset is putting me closing towards my goals.

Good trading plan example

How do you write a trading plan?

- Know your trading playbook

- Manage your risk

- Have a realistic profit target

1. Know your trading playbook

You should have a playbook of trades that you know how to execute in the market. A playbook is a list of trades, each with step-by-step instructions on how to trade the pattern.

If you don’t know what you should trade in your trading plan then building a playbook of trades is a good place to start.

2. Manage your risk

Risk management is a crucial skill for any trader. I’ve written an in-depth article on trading risk management for further information.

The reason risk management is so important is that without it we would blow up our accounts. Nobody would think about driving a car with no brakes because it would obviously crash – risk management is the brakes and safety system for our trading accounts.

Everyone has different risk profiles. Some are happy to take on high amounts of risk accepting that they may take hefty losses in order for the possibility of excess return.

Full-time traders like myself tend to be more cautious knowing that if they lose too much capital, they may have to go back to work.

You should include in your trading plan how much you’re prepared to risk on particular trades in your playbook and how much in your account overall.

3. Have a realistic profit target

Having an idea of a profit target will mean that you don’t end up falling into the trap of never selling. Far too many traders watch a stock rise, see it pullback, then immediately regret not nailing down profit into strength.

By setting out clear take profit targets this avoids indecisiveness and will ensure you execute ruthlessly.

Bonus tip: Trade the stocks in play

Trading is about being in stocks that are moving. Volatility is the lifeblood of a trader, and a dead stock means dead money.

The stocks ‘in play’ are the stocks that have moved or are moving in recent sessions, and the stocks we should be immediately keeping tabs on. Stocks can cycle in and out being in play, and so we need to keep track of those that offer the greatest volatility to trade.

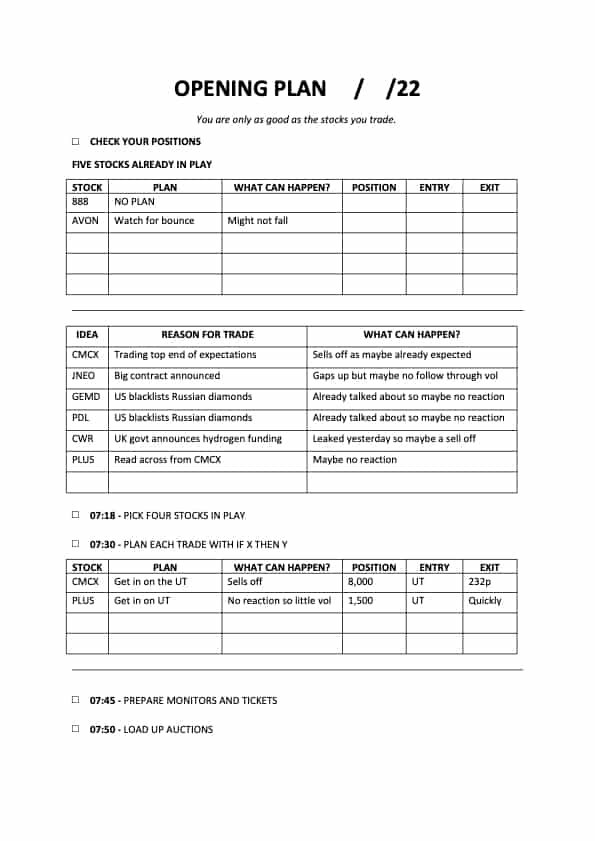

Download my free one-page trading plan template

My opening plan trading template has everything you need to begin the trading day. It forces you to check and review your open positions, so you’re always knowing what to do.

It also suggests to list the current stocks in play, and how you can trade them, and in what size. Additionally, it asks “What can happen?” so a trader using this template will never be caught out.

By thinking ahead about potential scenarios and how to trade them, this gives the trader an advantage over others who do not put the work in. Traders who punt around their money without a clue or a plan are commonly referred to as “liquidity”.

To download the free template, click the button below and follow the instructions.

About The Author

Michael taylor.

Too soon to get the course ? Get my free UK stock trading ebooks

Start typing and press enter to search

Almost there.

Enter your email below to receive my four free stock trading ebooks with everything you need to start trading the UK stocks.

Enter your email to receive my free trading plan template, with everything you need to begin the trading day.

Get your free stock trading ebooks

Get four free UK stock market ebooks and my monthly trading newsletter with trade ideas and things learned from trading stocks

Don't miss out!

IMAGES

COMMENTS

Writing a trading business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan: 1. Executive Summary. An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and ...

Mar 29, 2024 · Here’s an online trading business plan sample of ABC Trading: Executive Summary ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

400+ sample business plans will guide you through each section of your plan as a business mentor. 1. ... Trading Business Plan | Business Plan [YEAR] 15/52.

May 11, 2022 · Trading Plan Template FREE Downloads. In this section, we have created free trading plans that you can use in the format of your preference. Trading Plan Template PDF; Trading Plan Template Google Sheets ; Trading Plan Template Word; How to Build Your Trading Plan Template in 6 Easy Steps

What is a Trading Business Plan? A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans. Why You Need a Business Plan for a Trading Company

Jul 15, 2023 · A trading plan should resemble a business plan. A trader’s capital is their business and so we need to include everything that might be useful, but it should always cover the below. What to include in your trading plan. The time required to spend on your trading; Your trading goals and targets; Your risk tolerance and risk management rules